According to the “Technology Investment Analysis: Linking IT Choices to Market Leading Business Performance” from Rubin Worldwide, commissioned by Broadcom, inflation totaled 4.8% and outpaced the average 4.1% projected increase in budgeted technology spending at many organizations. This estimated increase in IT spending will not be enough to cover the basic costs of an organization’s IT components (e.g., hardware, software, network, outsourced services, etc.). Dr. Howard Rubin, CEO of Rubin Worldwide, says that organizations need to adopt a new mindset for the current economic revolution, which is being led by technology.

To address inflationary pressures, get the most from IT investments, and ensure business needs are met in an optimal way, organizations need to take three steps:

- Adopt a technology economy mindset and assess the organization’s tech stack as a portfolio of investments.

- Evaluate IT asset classes based on performance and their impact on business outcomes.

- Take a closer look at what and how the organization pays for assets.

Technology Components Are Assets, Not Commodities

According to Dr. Rubin, companies mainly invest in the “next best thing” when it comes to technology. If the trend is to invest in cloud or artificial intelligence, most companies do that because they see it as a new tool they should invest in to maintain a competitive advantage.

“The notion of considering technology components as asset classes is relatively new. And we believe it's powerful,” says Dr. Rubin. “Most companies don’t consider technology as asset classes.”

When companies consider technology as assets, they have economic scale and an ability to generate returns on investments in those assets. He says, “Companies consider technology to be commodities that are bought and sold, and the costs associated with those transactions.” To change the company mindset and consider technology as assets, companies must weigh the characteristics of those assets and how they can distribute the cost and scalability across different asset classes to make intelligent investment decisions that generate future business returns.

Dr. Rubin also says that to view technology as asset classes, companies need to account for how inflation impacts the costs of those assets from the hardware and software to the labor and energy costs. This is where chief information officers (CIOs) can be critical. Dr. Rubin says, “The most successful CIOs today are technology economists, who can help the company understand the overall business value of their technology assets.”

Taking Stock of the Tech Stack

When determining how the company’s tech stack is stacking up in terms of investment return, companies need to account for not only the expense of staff compensation and benefits, but also how much is being paid for hardware, software, licenses and contracts, occupancy space where the stacks are housed, the power consumed, and other expenses. “Every technology asset class has different investment and return patterns, but one area where companies have little control is what is in demand,” says Dr. Rubin. “For instance, in the financial sector, customers may be moving away from the branch to the ATM and to the computer and now mobile devices. The bank then retains more data that is analyzed and used for transactions, which require more hardware, software, and power.”

Companies need to model not only their current costs and future business needs, but the potential market changes that could require upgrades to technology stacks, which then must be added to projections for compensation, software licensing costs, and other expenses that can be impacted by sociopolitical factors. Another part of the equation should include how technology assets perform. Are they achieving the outcomes the business expects and are they doing it in an optimal way? “Part of the technology inflation equation should be the multi-year contracts that can have long-term implications,” explains Dr. Rubin.

The platforms that store and use data to accomplish business operations also can carry higher costs even without adding new assets or tools to the mix. This can be due to higher labor or energy costs or because the company has higher volumes of data. Those expenses should be accounted for in projection models. This holds true for mainframe, distributed servers, private cloud, and public cloud. The true costs of platforms are tied to the cost of the hardware and its processing speed, storage capacity, storage costs, all the other pieces that help the system operate effectively, and the talent that’s needed to run it and maintain it.

“How does each platform behave as an asset class? Our research examines patterns of asset classes in technology to see what we can learn, and which technology assets help businesses achieve ‘best in class’ performance and a high operating margin,” explains Dr. Rubin. “Those ‘best in class’ performers are making profits over multiple years, have excellent customer satisfaction, and generate a good return on equity.”

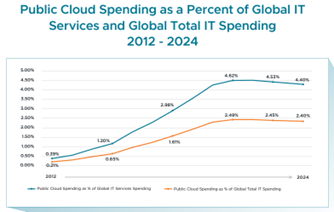

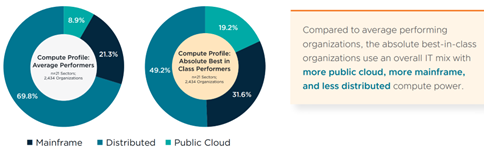

According to Dr. Rubin, “We found some very telling patterns and those patterns have to do with each business’ mix of asset classes.” The patterns don’t skew toward abandoning the mainframe for other platforms, and the research suggests that more businesses are investing in mainframe platforms. Across the board, there has been greater investment growth in private cloud, mainframe, and public cloud, but investment in distributed environments has declined. Dr. Rubin also notes a trend of investment shifting away from public cloud to private cloud.

“Public cloud hasn’t fulfilled its promise. And companies are making their technology investment choices based on performance,” he explains. “Across 20 sectors, the top performing companies examined have 46% more of their resources on the mainframe compared to the average company. Additionally, 29% less of their resources are on distributed servers, and companies have 5% of resources on public cloud, despite reports that public cloud spending rose 86%.” Public cloud spending has been stagnant over the last five years, accounting for just 5% of IT spending.

“What some companies found is that when they migrated applications from mainframe to public cloud, the operational costs on cloud were two to five times more than if the application ran on mainframe,” according to Dr. Rubin’s research. He adds, “Mainframes are massively scalable systems, with high computational rates and built-in security. With public cloud, companies found they needed more servers to complete the same tasks a mainframe could accomplish on its own. As you add server capacity in public cloud, costs go up, energy consumption increases, and water use rises.”

With mainframe, businesses know what they are getting: scalability, cost-effectiveness, security, high processing speed, and adaptability. But the key to becoming a top performing business is to find the right mix of technology assets for the work being done. “It's like managing a financial portfolio. Making technology investment choices should be based on asset classes and their characteristics, as well as the scale of the business. Watch the balance of assets. These decisions should not be choices made independently of what the business is doing,” says Dr. Rubin. Reviewing different platforms in terms of how they affect business outcomes should be a deliberate and intentional process, rather than simply chasing the newest tool or platform.

IT Asset Decisions

About 70% of the average business’ IT budget is spent on running the business, according to the research. Companies will need to make investments to keep their current technology always operating efficiently and ensure its scalability without significantly adding to expenses. At the same time, the business needs to channel investments into assets the company needs for improved business outcomes.

When doubling the size of the mainframe and its components, for example, unit costs actually decline 67%, but when doubling servers, costs rise. Costs shouldn’t be the only consideration, according to Dr. Rubin. Operating expenses for IT use have increased 50% in the last five years. As more businesses become reliant on technology, those costs will rise. According to the research, when companies review various returns on investment, mainframe cost efficiency over cloud is growing. With each new mainframe, unit cost per millions of instructions per second (MIPs) is declining faster than the cost on cloud.

However, “the real key is the business outcome,” he adds. IT asset investments should be assessed in how much more efficient or effective the assets can make the overall business. “Does it bring you closer to your customer? Does it make you more competitive in the market?

These are the questions that should be asked of every technology investment,” Dr. Rubin says. “What capabilities does each asset have? What’s the investment strategy that’s going to improve business outcomes and enable the business to process, store, and secure more customer data in the most cost-effective way.” Businesses also need to plan five to 10 years ahead when making investments and CIOs can help them address future business outcomes with multiyear investment strategies based on careful modeling that accounts for economic factors, business needs, and customer satisfaction. “The businesses that are the top performers are those with hybrid strategies,” says Dr. Rubin.

Serena Agusto-Cox has more than 20 years of editorial experience and six years of experience writing about mainframe and information technology. She interviews and crafts forward-looking and engaging technical updates related to the mainframe ecosystem, highlights the experiences of thought-leaders in the community, and shares important updates to technical education and training.